LiteFinance Review

LiteFinance Forex Introduction

LiteFinance (ex. LiteForex) is an online ECN broker that offers its clients Tier 1 liquidity in various markets since 2005. Clients can trade all major and cross currency pairs, oil, precious metals, stock indexes, blue chips, and a large selection of cryptocurrency pairs at LiteFinance broker (ex. LiteForex). In this LiteFinance review, we will delve into the various aspects of this broker, including its trading platforms, account types, trading conditions, customer support, and more.

LiteFinance aims to make online trading accessible to everyone, regardless of their level of experience or knowledge about the financial markets. LiteFinance forex broker stands out due to its user-friendly platforms, competitive spreads, and a wide variety of trading tools. The broker offers a range of account types to suit different trading styles and investment goals. With robust security measures in place, LiteFinance broker ensures a safe and secure trading environment for its clients. The broker also prioritizes customer service, providing round-the-clock support to address any queries or issues. With LiteFinance, traders can expect a seamless and efficient trading experience.

LiteFinance Account Types

ECN Account

- A minimum deposit of $50 is required.

- The quoting precision has been enhanced.

- Market execution is guaranteed with no requotes.

- There are no stop and limit levels.

- Both scalping and news trading are permitted.

- Transactions can last for an unlimited duration.

- Trades are sent directly to liquidity providers.

- NO conflict of interests.

- The social trading platform is accessible.

- The leverage stands at 1:1000.

- Negative balance protection

Demo ECN Account

A LiteFinance DEMO ECN account is a useful tool for both novice and experienced Forex traders. It allows you to test different trading plans and strategies without risking any money. You can experiment with various ideas and find the best system that will bring you profits when you trade on a real account.

Classic Account

- The minimum deposit required is $50.

- Enhanced quoting precision

- Guaranteed market execution without any requotes

- Leverage ratio is 1:1000

- Offers social trading

- Floating spreads from 1.8 points

- NO commission

- Offers an Islamic account.

LiteFinance Swap-Free Account

These accounts are compatible with Islamic principles, as they do not involve any interest on overnight positions. They also do not impose any extra charges or widen the spreads for the traders. The trading conditions are the same as for regular accounts. The traders can use any strategies or advisors they want. They can choose from any account types – CLASSIC, CENT, or ECN with raw spreads – according to their preferences.

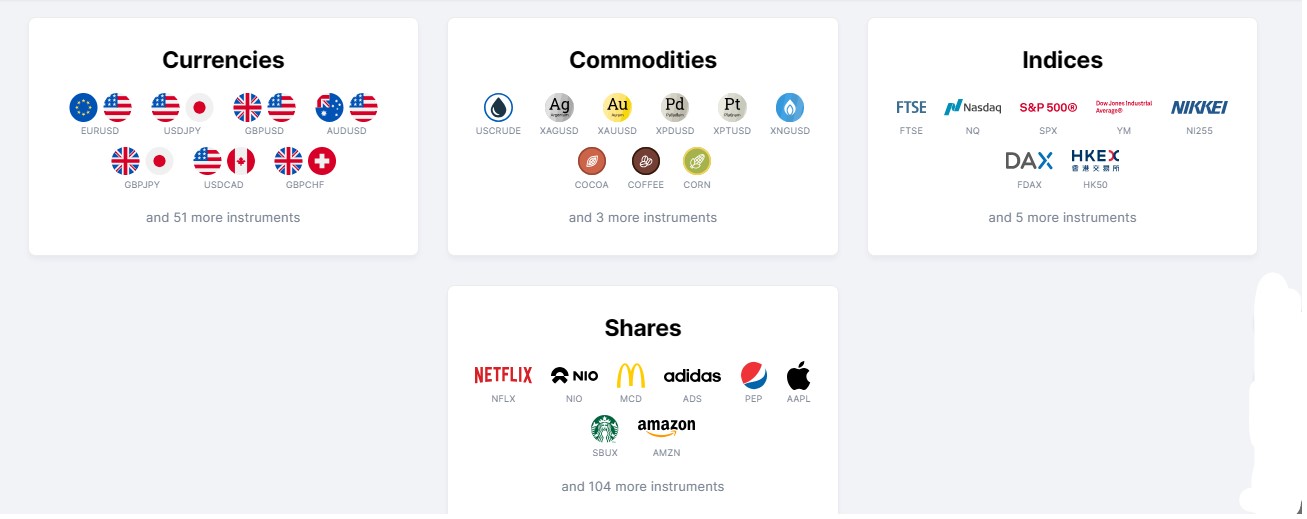

Trading Assets

Currency

- Access to unlimited liquidity of global currencies;

- Ability to trade anytime during the weekdays;

- Variety of popular currency pairs to choose from;

- Possibility of hedging and diversifying your risks;

- Fast and reliable order execution.

Global Stock Indexes

- High liquidity.

- Hedging market risks.

- Speculating on economic news releases.

- Low margin requirements.

- Diversifying the investment portfolio across different financial instruments.

Commodities

- Global trends can be clearly seen.

- The market is trending.

- Trading takes place 24 hours a day, 5 days a week.

- It always has high liquidity.

- It’s an alternative investment option to currency trading.

CFD NYSE

- Earn high and steady incomes with a low initial investment.

- Trade with sums that are much larger than your own margin.

- Execute trades quickly and efficiently.

- Trade on the assets of the largest and most reputable companies (“blue chips”).

- Enjoy low spreads and margin requirements, as well as high leverage.

NASDAQ

CFD NASDAQ is a powerful Forex tool that enables trading with shares of the world’s leading corporations, especially tech giants like Apple, Facebook, Google, Intel, Microsoft, and CISCO. These companies have proven their liquidity over time. CFD NASDAQ connects LiteFinance’s customers to the NASDAQ American stock exchange. The growth rates of these securities are publicly accessible, which allows traders to monitor the most successful companies and optimize their Forex profits in the future.

EURONEXT

Some of the largest European companies listed on EURONEXT are L’oreal, Renault SA, Unilever NV, ASML Holding MV and more.

Unlike American stocks, which often have stable long-term bullish trends, European stocks listed on EURONEXT are not as predictable. To trade them, one needs to study the corporation’s industry and financial reports.

LONDON LSE

The text below lists some of the largest British and global companies that trade on the London Stock Exchange (LSE), such as Vodafone Group, British American Tobacco, Barclays, HSBC Holdings, and more.

To devise a trading strategy for these companies’ shares, a trader needs to consider various fundamental factors. These include the industry outlook of the company, its financial performance, debt level, geopolitical risks, investor confidence, and currency and commodity prices that affect the company’s product.

XETRA

XETRA is an international e-trading system owned by Deutsche Börse, the largest financial organisation in Germany, and headquartered in Frankfurt am Main. It mainly trades in euros and allows investors to buy and sell American or Global depositary receipts from companies such as CitiGroup, Vodafone, and Sony, among others. It also offers access to various financial instruments, including ETFs and corporate bonds. XETRA is the platform where the German index DAX, a crucial indicator for the German and European economies, is calculated. As one of the world’s most liquid e-trading venues, XETRA leads Europe in liquidity concentration.

LiteFinance Deposit Options

LiteFinance offers several options for deposits to ensure it is convenient for their customers.

- Bank Cards: This is the most common method of depositing money. Customers can use their credit or debit cards to make deposits. This includes cards like Visa, MasterCard, American Express, among others. It’s a quick and easy way to transfer money into your LiteFinance account.

- Bank Wire Transfers: This deposit option involves transferring money directly from your bank account to your LiteFinance account. This method is safe and secure, although it might take a few days for the money to appear in your account.

- Electronic Transfers: LiteFinance also accepts electronic transfers. This could be through online banking or mobile banking apps. It’s a convenient and fast way to deposit money, especially if you prefer not doing it physically.

- Cryptocurrencies: For those who own cryptocurrencies, LiteFinance allows deposits using this method. This could include Bitcoin, Ethereum, and other popular cryptocurrencies. This option is ideal for those who prefer using digital currencies for their transactions.

In conclusion, LiteFinance provides multiple deposit options to cater to the varied needs of its customers. Whether you prefer traditional methods like bank cards and wire transfers or more contemporary methods like electronic transfers and cryptocurrencies, LiteFinance has got you covered.

LiteFinance Withdrawal Options

- Bank Wire Transfer: This withdrawal option typically takes 3-5 business days to process. The processing time may vary depending on your bank’s processing times and holidays.

- Credit/Debit Card: Withdrawals to credit or debit cards usually take 2-5 business days to process. This time frame may vary based on your card provider’s processing times.

- E-Wallets (PayPal, Skrill, Neteller): E-wallets are one of the fastest withdrawal options available, typically taking up to 24 hours to process. However, the processing time can be instant in some cases.

- Cryptocurrency Wallet: Withdrawals to a cryptocurrency wallet such as Bitcoin or Ethereum are typically processed within 24-48 hours. However, the processing time can be quicker depending on the blockchain network’s congestion.

- Direct Transfer to Trading Account: If you are transferring funds to another trading account, the processing time can be instantaneous or take up to a few hours.

Please note that the processing times can vary based on different factors, such as the time of your request, the withdrawal method you choose, and your bank or card provider’s processing times. Also, LiteFinance may require additional time to review and approve your withdrawal request before it is processed.

Trade with Different LiteFinance Trading Platforms

- LiteFinance MT4 (MetaTrader 4) is a widely used platform for Forex trading and analysis. It enables users to trade in currencies, shares, precious metals and CFD on stock indices. LiteFinance broker clients can download MetaTrader 4 trading platform and its mobile apps for PDA, iPhone®, iPad ™ and Android.

- MetaTrader 5 is an upgraded forex trading platform with more features and tools than its predecessor. LiteFinance forex broker offers both the desktop and the iPhone® versions of the LiteFinance MT5 software for download.

- cTrader is a trading platform that offers many benefits for Forex and CFDs traders. It has a user-friendly interface, advanced chart drawing tools, fast execution, level II Market Depth, Autochartist, and extended algorithmic trading options. These features make LiteFinance cTrader a versatile and powerful platform for trading online.

- LiteFinance mobile Forex apps are for free. You can use these apps on your tablet or smartphone to access daily analysis, trading signals and strategies. The apps are compatible with Android and iOS devices. They support more than 8 languages and are regularly updated.

Trading Tools

- The Economic Calendar is a vital tool for Forex traders that updates in real time. It provides information on the key macroeconomic indicators and events that influence the performance of a specific trading instrument. The economic reports calendar is especially useful for those traders who base their trading strategy on fundamental analysis. By using the economic calendar, LiteFinance clients can stay informed of the latest news and trade more effectively and confidently on the Forex market.

- Forex Analysis & Market Forecasts – Get insights from experienced analysts on the trends and movements of major currency pairs, commodities, and cryptocurrencies. Read daily analysis and opinions on the global markets.

- Analytical Material from Claws&Horns – Claws&Horns has experienced experts who excel in the art of analysis. LiteFinance’s clients can now access all kinds of analysis, such as latest forecasts, unique reviews, expert opinions and more. These analytical materials are essential for successful trading.

- Trader’s Calculator – With the LiteFinance Trader’s Calculator, you can estimate the potential profit or loss of a current or planned position. You just need to input your account type, currency, trading instrument, lot size, and leverage size.

- Fibonacci Calculator – A Fibonacci Calculator from LiteFinance can help you trade and calculate price retracements, and improve your Forex strategy. This is a powerful tool of technical analysis that enables you to optimize your trading on the Forex market.

- Currency Rates – Stay updated on the latest movements of exchange rates for all pairs and make smart trading choices. In this section, you can also view online currency rates and their historical changes on Forex for the past two years.

- Economics News – A summary of the global economy and finance based on the latest trends in foreign exchange and stock markets.

Education and research

LiteFinance Education and Research is a segment that provides educational resources and research materials to enhance the knowledge and skills of forex traders. It provides a comprehensive understanding of the forex market, trading techniques, trends analysis, and more.

- LiteFinance Webinars are a series of online seminars conducted by experienced traders and trading experts. These webinars are aimed to guide novice and experienced traders alike on various trading strategies, market trends, risk management, and other related topics.

- Forex Glossary is a comprehensive list of commonly used terms and definitions in forex trading. It is intended to help traders understand industry jargon and communicate effectively.

- Forex Books are a collection of publications that provide insight into the world of forex trading. These books cover a wide range of topics, including trading strategies, risk management, market analysis, and trading psychology.

- Trading Strategies are systematic plans used by traders to create a profitable trading process. LiteFinance provides various types of trading strategies that suit different types of traders and market conditions. These strategies are tested and proven to improve trading performance.

- LiteFinance Traders’ Reviews is a platform where traders share their experiences, strategies, tips, and reviews about LiteFinance platform. It provides valuable insights to other traders and helps them make informed decisions.

Is LiteFinance Legal?

LiteFinance is a Legalimate forex broker that provides a platform for individuals and businesses to engage in foreign exchange trading. They operate under strict regulatory guidelines, ensuring that their practices are transparent, fair, and compliant with financial laws. Offering a range of services, including currency trading, commodity trading, and indices, LiteFinance broker aims to provide a seamless and efficient trading experience. Their platform boasts advanced features designed to aid in making informed trading decisions, from real-time market updates to trend analytics. In addition, they prioritize the security of their clients’ funds, implementing robust safety measures to prevent unauthorized access and fraud.

Regulations

- LiteFinance Global LLC, a Limited Liability Company with registration number 931 LLC 2021, is incorporated in St. Vincent & the Grenadines. Its registered address is Euro House, Richmond Hill Road, Kingstown, St. Vincent and the Grenadines. Email:

- Liteforex (Europe) LTD, a Cyprus Investment Firm (CIF) with the registration number HE230122, is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 093/08 in accordance with Markets in Financial Instruments Directive (MiFID). The Investor Compensation Fund (subject of eligibility) insures all retail clients’ funds. Email:

- LiteFinance Global LLC does not serve residents of the EEA countries, USA, Israel, Russia, Japan, and some other countries.

LiteFinance Review – Conclusion

In conclusion, LiteFinance Broker is a reliable and efficient platform for managing financial investments. Its user-friendly interface, comprehensive financial tools, and high-quality customer service make it an ideal choice for both novice and experienced investors. The platform’s commitment to security and transparency further enhances its reliability. Whether you’re looking to grow your investment portfolio or just starting out in the world of finance, LiteFinance Broker can provide the support and resources you need to achieve your financial goals.

Check out our Binary Options Trading Review here.